- Plasma

- Posts

- Where Money Moves - Edition #6

Where Money Moves - Edition #6

Plasma announces XPL, Circle’s IPO, Worldpay’s stablecoin push, and more.

Financial disruption isn’t being led by crypto-native platforms anymore; it’s coming from the intersections between blockchain infrastructure and traditional financial rails. At this point, stablecoins have become a hot topic for everything from consumer payments to bank policy discussions.

Why? Because stablecoins are more than just digital dollars; they are the backbone of today’s crypto markets and the foundation for a new global financial system. In short, understanding where stablecoins are today helps reveal where modern finance is headed next.

Plasma Enters its Next Phase with XPL Token Sale

We’re thrilled to announce that Plasma’s XPL token supply will be made available to the public via Sonar, Echo’s new token sale infrastructure. XPL is integral to Plasma’s core functionalities and will secure the PlasmaBFT consensus mechanism, power execution through the Reth-based EVM, and underpin Plasma’s trust-minimized Bitcoin bridge.

10% of the total XPL supply will be sold in the public sale, priced at a $500 million fully diluted network valuation, matching our recent strategic raise led by Founders Fund. If you are interested in helping scale the network from the ground up, learn more from our announcement.

Stablecoin Spotlight: What’s Top of Mind

According to the Wall Street Journal, some of the largest US banks are now exploring stablecoins as an essential part of their digital payment strategies. The entire traditional banking industry is in catch-up mode, with major players like JP Morgan, Bank of America, and Citigroup considering the possibility of jointly issuing their own stablecoin.

At the same time, fresh data from Artemis reveals that in emerging markets, stablecoin payment volumes, primarily that of USD₮, are reaching parity with traditional rails, particularly in regions where banking infrastructure has lagged. What’s striking is not just the speed of adoption, but the breadth of use cases now emerging as existing financial giants act decisively in the face of inevitable stablecoin adoption.

What’s New with Stablecoins

Circle, issuer of the second largest stablecoin, USDC, has continued with its efforts to go public on the NYSE, revealing its ticker as CRCL. Notably, USDC’s supply has decreased over the last month, in stark comparison to that of USD₮, which has risen by over $5 billion. CRCL is scheduled to get priced on Wednesday.

Stablecoins will be the first type of digital asset enabled as a payout option on Worldpay’s payout platform. With this, Worldpay clients in the US and Europe will be able to make stablecoin payments to customers, contractors, creators, sellers, and other third-party beneficiaries across more than 180 markets.

OpenPayd is rolling out a stablecoin infrastructure platform aimed at helping fintechs and corporates issue, manage, and integrate stablecoins into their financial workflows. With OpenPayd processing nearly $150 billion in annualised volume for 750+ clients across a diverse range of industries, this is a significant step forward for stablecoin adoption.

In an unprecedented move, the Bank of Korea is considering integrating stablecoins issued by private institutions with public blockchain networks. This marks a significant departure from traditional CBDC strategies, and could set a new global precedent for how national financial systems interact with decentralized infrastructure.

In Other News

Conduit raises $36 million in a Series A round for its cross-border stablecoin payments platform.

Bitget launches BGUSD, a yield-bearing stable asset backed by tokenized real-world assets.

Velocity announces $10 million pre-seed round, Europe's largest stablecoin infrastructure raise this year.

Stablecoin Adoption Snapshot

1️⃣ Stablecoin Supply & Growth

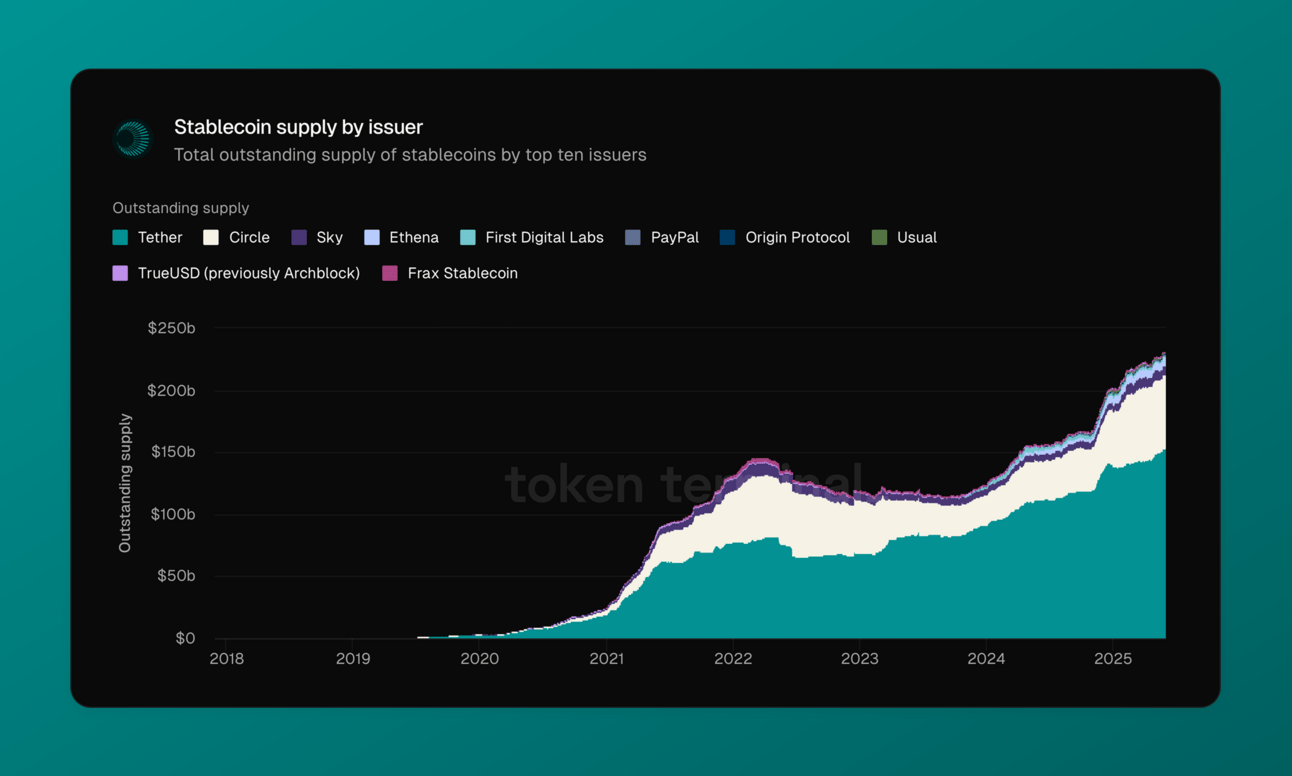

Stablecoin supply continues to grow unabated, with USD₮ remaining the undisputed leader in total stablecoin supply. This continues the surge in stablecoin supply that has remained unbroken since October 2024.

Total stablecoin supply: $244.8 billion (+2.88% from 30 days ago)

USD₮ remains dominant: 62.5% market share ($153.1 billion)

Stablecoins now account for over 1.10% of the US M2 money supply

Stablecoin supply

2️⃣ Adoption Continues to Surge

Stablecoin transaction volume has continued to climb over the past two weeks, alongside a steady increase in new wallets holding stablecoins.

$4.0 trillion in stablecoin transaction volume over past 30 days (via 946.7 million transactions)

165.3 million wallets hold stablecoins (up 3.3% from 30 days ago)

100.5 million wallets hold Tether's stablecoin, making it the clear market leader

Stablecoin transfer volume

3️⃣ Stablecoin Liquidity by Chain

While Ethereum has regained some stablecoin market share over the past two weeks, Tron’s stablecoin activity continues to grow at a faster pace, driven predominantly by USD₮.

Ethereum remains dominant in terms of stablecoin supply, with 53.5%, followed by Tron at 32%

Smaller chains have seen a small but sustained increase in stablecoin supply, up 4.4% over the past year as cross-chain activity grows and new stablecoins are launched.

Stablecoin supply by chain

All data and charts in the Stablecoin Adoption Snapshot are courtesy of our partner, Token Terminal. Please note that while the underlying data points are accurate, certain chart segments may appear incomplete as Token Terminal continues integrating Solana. For fully verified data sets, refer to the figures provided throughout this newsletter.

Plasma: Where Money Moves Next

Stablecoins are not adapting to the existing financial system. Rather, the financial system is creating new models with stablecoins at their core. As stablecoins become part of everyday commerce and global banking, the world needs a programmable, stablecoin-specific foundation for a future where value moves at internet speed.

That’s why we’re building Plasma. As stablecoins transition from crypto-native assets to a global money standard, they need faster, cheaper, more reliable and more programmable settlement infrastructure. Plasma is designed from the ground up for this future.

Whether you're a developer, investor, or simply watching where money moves next, Plasma is where the future is being built.